Vanguard Releases 2026 Economic and Market Outlook

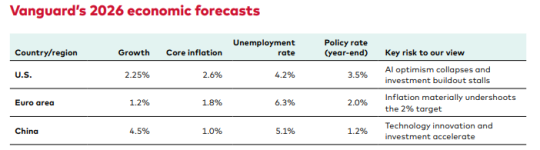

Vanguard released its annual outlook on the global economy and financial markets. This year’s report, “AI exuberance: Economic upside, stock market downside,” provides investors an economic roadmap and Vanguard's updated long-term investment thesis.

Our capital markets projections show that the strongest risk-return profiles across public investments over the coming five to 10 years are, in order: 1. High-quality U.S. fixed income. 2. U.S. value-oriented equities. 3. Non-U.S. developed markets equities

Each year, I take these predictions with several grains of salt.

My thoughts on the "AI Bubble" are: (1) There's a reason the investment dollars are rolling in fast and furiously. Getting in position first will pay off for a couple of key players. (2) The "losers" in this AI arms race are going to face serious financial repercussions. (3) Much like during the Gold Rush in the 1800's, those selling the picks and shovels are probably best positioned to take advantage of this craze.