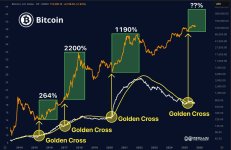

BTC and the Golden Cross

- Thread starter MadJack

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

John Bollinger is a legend and he’s seeing similar moves for ETH comparable to 22’.

FOMC tomorrow. Looks like it came back to the dead cat bounce area and may be heading back to the value area low of 108k or even lower.

Definitely rejected. Taking profits on the trade here for BTC.

Nobody ever went broke taking profits. This is just my swing trade from this post. (9 days)

Definitely rejected. Taking profits on the trade here for BTC.

Nobody ever went broke taking profits. This is just my swing trade from this post. (9 days)

BTC 112.5 and 112.1, final target at 111.5-111.6.

Will rejoin the party somewhere around there if given the opportunity tomorrow.

Always another trade. 👍🏼

EDIT:

Looking at 110,950 area for entry if it presents itself. $111k is a local Fibonacci.

Edit #2 Didn’t even try. Jerome Powell could sneeze weird and crypto take a nose dive.

Edit #2 Didn’t even try. Jerome Powell could sneeze weird and crypto take a nose dive.

Will rejoin the party somewhere around there if given the opportunity tomorrow.

Always another trade. 👍🏼

EDIT:

Looking at 110,950 area for entry if it presents itself. $111k is a local Fibonacci.

Edit #2 Didn’t even try. Jerome Powell could sneeze weird and crypto take a nose dive.

Edit #2 Didn’t even try. Jerome Powell could sneeze weird and crypto take a nose dive.

Last edited:

$BTCUSD next stop 105.5k 105,451.85 Coinbase to be exact This is from a Moderator on TV. He’s been money on the levels this week. EDIT ✍️ Last post heading out to travel for fun remainder of week: This is your buy zone!! $BTCUSD 97,769.44 Coinbase looking more and more likely. Sister fib at 105,451 was pierced on last hit, so is unlikely to hold again, and the 97.769 fib would be a perfect sub 100k stop hunt I have a leveraged (10x) buy order at $97,950 that I hope to ride into all time highs. Approx. $10k risked to ride back into all time highs. So 6x risk reward. Stop loss 1%. Trick and then treats in November. |

Last edited:

$97.7k looking more realistic. I’m waiting on bullish divergence and an SPF (swing failure pattern) on the higher time frame. $160k a possibility but might be Q1 with stock market currently risk off.

Best thing to do is just enjoy the show and count your dough in a few months.

But then again tomorrow is a full moon… you never know lol

Best thing to do is just enjoy the show and count your dough in a few months.

But then again tomorrow is a full moon… you never know lol

Buy!!!We having fun yet?

I ain't going anywhere.

It cycles like this over and over.

- Sep 24, 2005

- 8,719

- 2,589

- 113

What’s going on with this coin is pretty wild. Do you think it can hold at this level, or does it test the 78k floor? It’s amazing that so much of the wealth being created today comes from technologies that still haven’t demonstrated broad, tangible use cases—AI, crypto, quantum computing. Yet the market doesn’t seem to care, as long as people are making money.We having fun yet?

I ain't going anywhere.

It used to be that value was tied to companies selling real, measurable products—soup, toys, retail goods, appliances—things everyone could understand. Today, the market is driven far more by narratives, charts, and speculation. And honestly, if you understand how the marketing and momentum work, you’re already ahead of most.

Eventually, the biggest companies with trillions in investment behind them tend to find their footing. But meanwhile, the small-business sector I work in keeps deteriorating, right along with the financial stability of a large share of consumers. At this point, anything that actually makes money in a speculative environment feels like a good call, regardless of whether it has the traditional use-value to justify earnings. As long as we remain in this era of speculation and strong narratives, the run will likely continue.

I think we'll see lower than that but nobody knows. I'll just continue to buy the first week of every month because I am a believer.Do you think it can hold at this level, or does it test the 78k floor?

- Sep 24, 2005

- 8,719

- 2,589

- 113

Good luck Jack!I think we'll see lower than that but nobody knows. I'll just continue to buy the first week of every month because I am a believer.

my buddy Grok says....

As of November 18, 2025, Bitcoin is trading around $91,000–$91,500 after dipping as low as $89,426 earlier today—the lowest since April. This has erased all of its 2025 gains so far, with the broader crypto market in "extreme fear" territory amid ETF outflows totaling over $2 billion in the past three weeks, whale selling (15,924 BTC moved to exchanges in the last five days alone), and macro headwinds like fading odds of a December Fed rate cut (now ~40%) and persistent inflation surprises.

cnn.com +4

Short-Term Outlook: Unlikely to Hold Firmly at ~$91K Without a Bounce FirstThe path of least resistance right now is downward. We've seen a "death cross" (50-day MA crossing below the 200-day MA) confirm bearish momentum, over $815 million in liquidations this week, and a breakdown below key supports like $96K (weekly close) and $92K (psychological/liquidity zone).

coindesk.com +2

Sentiment on X (formerly Twitter) echoes this, with traders widely expecting a retest of $88K–$90K as immediate support before any deeper slide—many calling it a "liquidity sweep" or Wyckoff distribution phase.

If it fails to reclaim $95K–$98K quickly (e.g., by week's end), we could see a flush lower in the coming days, driven by spot selling rather than just leveraged longs getting wrecked.That said, $90K isn't a hard floor yet—it's more of a magnet for sellers hunting stops. A brief rebound to $93K–$95K (testing resistance turned support) wouldn't surprise me if spot CVD (cumulative volume delta) shows easing outflows, but sustained holding here feels optimistic without fresh catalysts like stabilizing ETF flows or positive macro data.Will It Test the $78K Floor? High Probability in the Next 1–2 WeeksYes, I think it tests around $78K (or the $74K–$80K band) soon—probably by late November or early December. Here's why:

coindcx.com

If you're positioned long-term, sit tight; if trading, scale in on that dip. This feels like the pain before the gain—crypto winters are short, bulls are long.

As of November 18, 2025, Bitcoin is trading around $91,000–$91,500 after dipping as low as $89,426 earlier today—the lowest since April. This has erased all of its 2025 gains so far, with the broader crypto market in "extreme fear" territory amid ETF outflows totaling over $2 billion in the past three weeks, whale selling (15,924 BTC moved to exchanges in the last five days alone), and macro headwinds like fading odds of a December Fed rate cut (now ~40%) and persistent inflation surprises.

cnn.com +4

Short-Term Outlook: Unlikely to Hold Firmly at ~$91K Without a Bounce FirstThe path of least resistance right now is downward. We've seen a "death cross" (50-day MA crossing below the 200-day MA) confirm bearish momentum, over $815 million in liquidations this week, and a breakdown below key supports like $96K (weekly close) and $92K (psychological/liquidity zone).

coindesk.com +2

Sentiment on X (formerly Twitter) echoes this, with traders widely expecting a retest of $88K–$90K as immediate support before any deeper slide—many calling it a "liquidity sweep" or Wyckoff distribution phase.

If it fails to reclaim $95K–$98K quickly (e.g., by week's end), we could see a flush lower in the coming days, driven by spot selling rather than just leveraged longs getting wrecked.That said, $90K isn't a hard floor yet—it's more of a magnet for sellers hunting stops. A brief rebound to $93K–$95K (testing resistance turned support) wouldn't surprise me if spot CVD (cumulative volume delta) shows easing outflows, but sustained holding here feels optimistic without fresh catalysts like stabilizing ETF flows or positive macro data.Will It Test the $78K Floor? High Probability in the Next 1–2 WeeksYes, I think it tests around $78K (or the $74K–$80K band) soon—probably by late November or early December. Here's why:

- Technical Setup: The drop aligns with a descending channel from mid-October's $126K peak, targeting the 161.8% Fibonacci extension at $74K–$76K. We've already filled major imbalances down to $88K–$90K, and historical patterns (e.g., April's $74.5K low) suggest this zone as the next demand area. The 100-day EMA is converging there too, acting as dynamic support.

forbes.com +3

X chatter reinforces this, with calls for $80K, $75K–$85K, or even $72K–$74K as the "real bottom" before reversal.

- Market Dynamics: This isn't just noise—it's a self-fulfilling prophecy. New entrants (post-Trump election hype) are offsetting sales, but with retail sidelined (broke from prior volatility) and institutions pausing (e.g., MicroStrategy's buys can't fully counter $870M ETF redemptions in one day), liquidity thins out below $85K.

tradingview.com +2

Nearly a third of BTC supply is now in unrealized losses, which historically precedes capitulation but sets up stronger bounces. - Counterarguments for a Hold: Bulls point to seasonality (November median +9% historically) and long-term scarcity (95% of BTC mined), plus institutional conviction (e.g., recent $835M buys). If we close the week above $90K with volume pickup, it could fake out bears and reclaim $100K. But odds feel ~30% right now—too much downside momentum.

99bitcoins.com +1

coindcx.com

If you're positioned long-term, sit tight; if trading, scale in on that dip. This feels like the pain before the gain—crypto winters are short, bulls are long.

Is that the brown smear or the brown log?I think $75k is as low as it can go without huge structural damage and severe liquidations. Too many people can't have that happen.